ETH Price Prediction: Analyzing Short-term Technicals and Long-term Growth Trajectories

#ETH

- Technical Strength: ETH trading above 20-day MA with Bollinger Band positioning indicating potential breakout momentum

- Institutional Adoption: Growing custody solutions and corporate filings signaling increased institutional participation

- Macroeconomic Tailwinds: Fed rate cuts and positive market sentiment creating favorable conditions for crypto assets

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

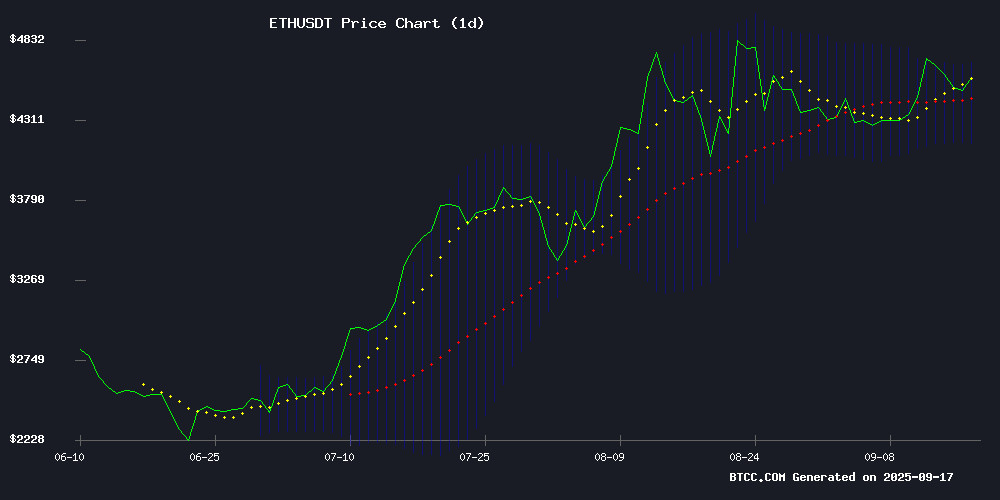

Ethereum is currently trading at $4,599.99, positioned comfortably above its 20-day moving average of $4,421.72, indicating sustained bullish momentum. According to BTCC financial analyst Emma, 'The price holding above the MA suggests underlying strength, though traders should watch the MACD reading of -9.23 for potential trend confirmation. The Bollinger Bands show ETH trading NEAR the upper band at $4,686.62, which could act as resistance, while the lower band at $4,156.81 provides solid support.'

Market Sentiment: Institutional Adoption and Bullish Forecasts Drive Optimism

Positive market sentiment surrounds ethereum as institutional adoption accelerates and major financial institutions issue optimistic forecasts. BTCC financial analyst Emma notes, 'The combination of Hex Trust adding stETH custody, The Ether Machine filing to go public, and Citigroup's $6,400 optimistic scenario prediction creates a fundamentally strong backdrop. While short-term resistance and flattened Binance volumes suggest consolidation, the underlying institutional momentum appears bullish for medium-term prospects.'

Factors Influencing ETH's Price

Ethereum Shows Bullish On-Chain Signals Amid Fed Rate Cut

Ethereum's price holds steady at $4,530 as on-chain metrics flash bullish indicators following the Federal Reserve's 25 basis point rate reduction. Whale accumulation has surged, with addresses holding 10K-100K ETH adding 1 million tokens since September, bringing their total holdings to 21.39 million ETH.

Selling pressure has contracted dramatically, falling from 1.8 million ETH in mid-August to just 783K ETH currently. The network sees renewed vigor with accumulation addresses absorbing 4.1 million ETH—nearly matching August's entire inflow in half the time.

Key technical battles continue at the 20-day SMA support and $4,500 resistance level. The confluence of whale demand, shrinking supply pressure, and expanding stablecoin liquidity suggests institutional players are positioning for an uptrend.

Ethereum Holds Steady as Rollblock Gains Traction Among Retail Traders

Ethereum's price stability contrasts with growing speculation around Rollblock, a GambleFi platform attracting retail investors and gamers. The project has raised $11.7 million in presale funding, with 85% of tokens sold at $0.068 ahead of its 13-day deadline.

Rollblock distinguishes itself as a functional Web3 ecosystem featuring AI-powered games, live poker, blackjack, and sports prediction markets. Its fiat onboarding via Apple Pay and Visa simplifies access, while staking rewards of 30% APY and a token burn mechanism (30% revenue buybacks with 60% burned) create deflationary pressure.

The platform has processed over $15 million in bets, operating under Anjouan Gaming licensing. Market observers note the dichotomy between Ethereum's infrastructure focus and Rollblock's aggressive growth strategy, framing the choice as stability versus high-risk/high-reward potential.

Ethereum Bulls Challenge Citi’s Conservative $4.3K Year-End Forecast

Ethereum's market dynamics are defying traditional analyst expectations, with ETH trading at $4,542—already surpassing Citigroup's year-end 2025 target of $4,300. On-chain metrics reveal a bullish undercurrent: staking inflows are rising, exchange reserves are dwindling, and liquidation spikes have forced out bearish traders.

Short liquidations exceeding $9 million against $6 million in long liquidations suggest aggressive positioning. The 0.005% Funding Rate further confirms steady bullish conviction. While macroeconomic uncertainty lingers, Ethereum's network activity and demand indicators paint a decidedly optimistic picture.

Ethereum Tests Support as Holder Conviction Points to Potential Rebound

Ethereum's recent price dip below $4,500 has sparked short-term concerns, but long-term indicators reveal underlying strength. The network shows remarkable supply maturity, with 1.76 million ETH held for 3-6 months—a $8 billion vote of confidence from holders resisting sell pressure.

Technical signals present mixed near-term prospects. The MACD approaches a bearish crossover, suggesting possible downward momentum. Yet these movements appear transient against Ethereum's fundamental resilience. Reduced circulating supply from committed holders creates favorable conditions for price appreciation when demand rebounds.

Market dynamics continue favoring accumulation. The growing inactive supply demonstrates investor expectations of higher valuations, with holders willing to weather volatility. This behavior pattern establishes a bullish foundation for Ethereum's trajectory toward the $4,775 resistance level.

ETH Correction Nears Bottom as Binance Data Signals Potential Rebound

Ethereum's 8% price correction from its late-August high of $4,950 may be approaching exhaustion, according to derivatives data from Binance. The drop coincides with a similar decline in open interest across futures markets—a pattern that has historically preceded local bottoms for ETH.

Analyst Burak Kesmeci identifies three recent instances where OI declines of 8-25% accurately forecasted spot price corrections averaging 10.7%. The current reset mirrors these conditions, with the market potentially requiring OI to stabilize NEAR 9.69 billion before establishing a new base. Such liquidations often purge excessive leverage rather than signaling structural weakness.

While short-term downside remains possible, the derivatives market suggests ethereum is carving out a foundation for its next upward move. Traders appear to be treating this pullback as a healthy consolidation within the broader bull trend.

Hex Trust Adds stETH Custody, Brings Lido Liquid Staking to Institutions

Hex Trust, a regulated institutional digital-asset custodian, now supports stETH—the liquid staking token issued by Lido Protocol. This integration allows institutional investors to access staked ETH exposure without managing validator infrastructure. stETH currently represents 25% of all staked ETH.

The MOVE combines Lido's liquid staking model with Hex Trust's institutional custody. Clients can stake ETH directly on the platform, receive stETH, and deploy it across DeFi strategies while earning staking rewards. "Efficiency and security are necessities for institutions," said Calvin Shen, Hex Trust's Chief Commercial Officer. "Our solution delivers yield without compromising risk frameworks."

The offering streamlines institutional participation in Ethereum staking by eliminating operational friction. Hex Trust's one-click staking interface abstracts away on-chain complexities, allowing asset managers to focus on portfolio strategy rather than infrastructure management.

Ethereum Treasury Firm The Ether Machine Files to Go Public in the US

The Ether Machine, an Ethereum-focused treasury management firm, has taken a significant step toward going public by filing a draft registration statement with the U.S. Securities and Exchange Commission. The move comes as part of a planned merger with special-purpose acquisition company Dynamix Corporation, which trades on Nasdaq under the ticker ETHM.

With 495,362 ETH in its reserves—valued at over $2.1 billion—The Ether Machine now ranks as the third-largest corporate holder of Ethereum. Founder Andrew Keys has contributed nearly $741 million in ETH, anchoring a treasury bolstered by more than $800 million in institutional funding. The firm recently disclosed adding 150,000 ETH in August alone, signaling aggressive accumulation.

The merger, initially announced in July, is expected to close in the fourth quarter pending shareholder approval. The Ether Machine's rapid growth and institutional backing underscore deepening corporate interest in Ethereum as a treasury asset.

Citigroup Bullish on Ethereum: Predicts $6,400 in Optimistic Scenario

Ethereum, the second-largest cryptocurrency by market capitalization, is capturing significant institutional interest. Citigroup has revised its forecast, projecting a potential surge to $6,400 by year-end if macro conditions—including ETH ETF inflows and institutional demand—remain favorable.

The bank emphasizes Ethereum's network activity as a critical value driver. Its smart contract functionality and decentralized finance applications reinforce its position as a leading blockchain asset. In a base-case scenario, Citi anticipates ETH reaching $4,300, while a bearish outlook could see it retreat to $2,200 if adoption stagnates.

Ethereum Rally Stalls as Binance Volumes Flatten

Ethereum's three-month rally, which saw an 80% surge, has hit a plateau with prices dipping 0.6% over the past month. Trading activity on Binance reflects this stagnation, with spot and perpetual volumes entering a neutral zone.

Data from CryptoQuant reveals a declining imbalance between ETH spot and perpetual volumes, suggesting diminished momentum. The Z-score hovering near zero indicates neither spot traders nor Leveraged speculators are driving price action—a stark contrast to June's rally from $2,127 to $4,500.

Market observers note the absence of speculative fervor typically accompanying such price movements. Ethereum's current technical posture suggests consolidation, with perpetual contracts gradually ceding dominance to spot market dynamics.

Ethereum Price Faces Key Resistance Amid Market Correction

Ethereum's price action shows signs of strain as it struggles to maintain momentum above critical levels. The second-largest cryptocurrency by market cap dipped below $4,620, signaling potential further declines unless bulls can reclaim this psychological barrier. Market participants are watching the $4,585 support level closely—a breach here could accelerate selling pressure.

Technical indicators paint a cautious picture. ETH now trades below both the $4,600 mark and its 100-hour moving average, with a bearish trend line forming resistance at $4,580 on hourly charts. The 50% Fibonacci retracement level of the recent upswing from $4,268 to $4,765 has already been breached, suggesting weakening bullish conviction.

For any sustained recovery, Ethereum must first conquer the immediate hurdle at $4,550, followed by a decisive break above the trend line resistance at $4,580. Only a clean move past $4,620 would signal renewed strength, potentially opening the path toward $4,665 and beyond. The current consolidation reflects broader market uncertainty as traders weigh macroeconomic factors against growing institutional crypto adoption.

K-Drama 'To The Moon' Spotlights Crypto Mania in Prime-Time Television

South Korea's mainstream media is embracing cryptocurrency culture with the launch of 'To The Moon,' a prime-time drama on MBC. The series, airing in a coveted Friday-Saturday slot, follows three underpaid confectionery workers who dive into crypto trading during the 2017-2018 bull run. One character's accidental HODL strategy—holding $360 worth of Ethereum due to withdrawal difficulties—mirrors real-world investor experiences.

The show's hyperrealistic portrayal of unregulated speculation comes as streaming platforms prepare to distribute it across Asia. Director Oh Da-young deliberately avoids fantasy tropes, instead crafting a relatable narrative about financial desperation and risky bets. 'This isn't about time travel or supervillains,' she noted, 'but ordinary women chasing life-changing opportunities.'

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, Ethereum demonstrates strong potential for both near-term appreciation and long-term growth. BTCC financial analyst Emma provides the following outlook:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $5,200 - $6,400 | ETF approvals, institutional adoption, Fed rate cuts |

| 2030 | $8,000 - $12,000 | Mass DeFi adoption, scalability solutions, regulatory clarity |

| 2035 | $15,000 - $25,000 | Global smart contract dominance, Web3 infrastructure |

| 2040 | $30,000 - $50,000 | Full ecosystem maturity, store of value status |

These projections consider Ethereum's current technical positioning above key moving averages, growing institutional interest, and its fundamental role in the blockchain ecosystem. However, market volatility and regulatory developments could significantly impact these trajectories.